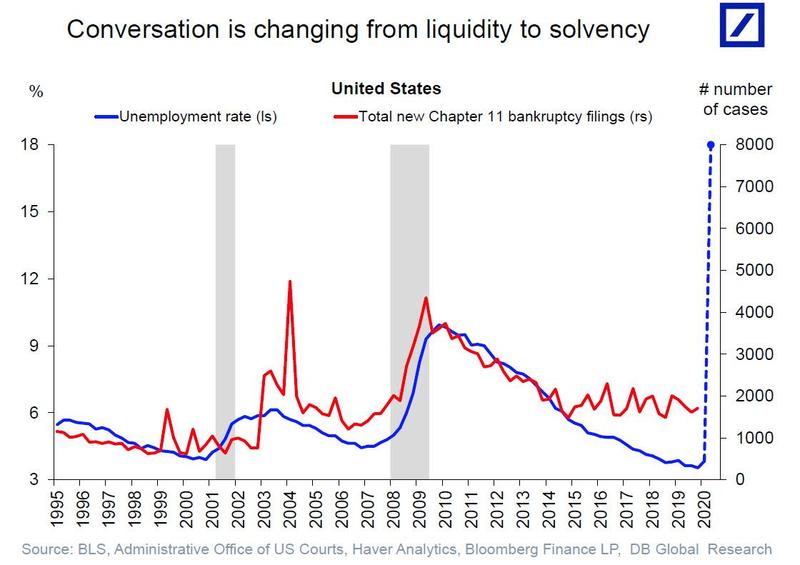

Two months ago, we reported that after the largest US bank had quietly exited the new loan issuance market, and hiked mortgage standards, JPMorgan also stopped accepting HELOCs, in what appeared to be a comprehensive withdrawal from the loan market ahead of the coming deluge of corporate bankruptcies spawned by the coronavirus shutdowns. This was confirmed just weeks later when in the latest Senior Loan Officer Survey we found that it has become next to impossible to get a loan as bank lending standards have soared for everything from C&I loans, to mortgages, to consumer loans.

Now, in the latest indication that banks are bracing for even more default pain, this time stemming from what even before the coronavirus crisis was the next subprime disaster-in-waiting, namely auto loans. According to CNBC, Wells Fargo is hitting the brakes on its auto loan business, until recently a major source of revenue for the company.

The bank, one of the biggest lenders for new and used car purchases in the U.S., sent letters to hundreds of independent auto dealerships last month telling them that the San Francisco-based company was dropping them as a customer, according to people with knowledge of the situation.

Wells Fargo confirmed that the bank, which only makes auto loans through car dealerships, will no longer accept loan applications from most independent shops which typically sell used cars, unlike franchise dealerships that focus on new vehicles from specific manufacturers.

The bank had “an obligation to review our business practices in light of the economic uncertainty presented by COVID-19 and have let the majority of our independent dealer customers know that we will suspend accepting applications from them,” Natalie Brown, the spokeswoman, told CNBC. “The independent dealers we will continue doing business with are those with deep, long-standing relationships with Wells Fargo.”

The move comes just as prices of used cars, which has crashed in late March and early April, had staged a modest rebound. However, with the fleet of 500,000 Hertz rental cars hitting the liquidation block after the company’s bankruptcy, and expect to send used-car prices plunging even more in the coming weeks, it’s not difficult to see why Wells is suddenly getting out of Dodge.

The move also follows Wells Fargo’s retrenchment from the mortgage market as the coronavirus pandemic took hold in the U.S. The bank is operating under a dozen consent orders tied to its 2016 fake accounts scandal, and one of those orders, from the Federal Reserve, limits the bank’s ability to grow its balance sheet until it fixes compliance shortcomings.

Yet the latest move was more related to concern about the credit quality of loans made by independent dealerships rather than the asset cap, a source told CNBC. This means that just like JPMorgan, Wells is now confident that the ‘credit quality’ of US consumers is about to disintegrate, resulting in a flood of defaults, and is trying to quietly eliminate all new loan exposure.

As we had reported previously, before the pandemic took hold, Wells Fargo had actually been growing its auto lending business. The company revamped the unit in 2018 after paying a $1 billion fine to the Consumer Financial Protection Bureau for fraudulently selling customers unnecessary auto insurance.

Since then, the company has steadily expanded the auto loans it held to $48.6 billion at the end of March, the bank’s second biggest category of consumer loans after mortgages. Auto loan origination climbed 19% in the first quarter to $6.5 billion, “reflecting our renewed emphasis on growing auto loans following the restructuring” of that business, the bank said in April. Needless to say, Wells wouldn’t shut off one of its most profitable revenue streams if it didn’t think that the coming losses would drown any possible upside from continued market penetration.

The silver lining is that – for now – the credit crunch focuses on a modest portion of Wells’ overall auto loan business. Independent shops, which as noted above focus on used cars, make up less than 10% of the 11,000 dealers Wells Fargo uses to sell auto loans, according to the person with knowledge of bank operations. However, it is only a matter of time before new car dealerships are swept up by the bank’s boycott of new loans.

Similarly to JPM, Wells Fargo has also been stepping back from parts of the mortgage market since the pandemic began this year. The bank told mortgage personnel that it was “temporarily” halting all new home equity lines of credit after April 30.

When analysts asked CFO John Shrewsberry in April why the bank was pulling back from the market, he said it was “one of the levers that we’re using to manage living under the asset cap” rather than concern about loan defaults.

As today’s action confirms, the CEO was simply lying, and here’s why.

This article appeared at ZeroHedge.com at: https://www.zerohedge.com/economics/banks-brace-default-wave-wells-fargo-stops-making-loans-independent-car-dealers

Credit: Source link